For the Canada, over the past year, web sites looks for pay day loan were increasing. It outnumber actively seeks various other style of loan as well as mortgage loans, figuratively speaking, integration financing, and you will car and truck loans. But not, as you have probably read, an instant payday loan are tricky providers.

Cash advance, labeled as a wage advance, is a quick fix that are quite high risk. Why he is so popular comes from the proportions and you can access to. Payday loans are for lower amounts, he could be really easy to qualify for while get money immediately.

Once you get your salary then you definitely pay back the borrowed funds. Audio a best? Not very timely, there was a big connect. These fund features typically 400% inside the interest.

They are sold because the payday loans you can buy inside the a keen crisis to take you through until payday. Although not, most people become are dependent on these pay day money to make ends up see. It causes a diminishing income. Every month you have smaller to invest until finally, the loan could be the measurements of an entire income. Many people have become trapped within up spiral from debt.

These companies are non-financial loan providers as well as address the brand new economically vulnerable one of people. He is made to be studied over to a short span of your time but users usually score caught by the unexpected charge. In addition, even more one short-period the fresh eight hundred% desire really adds up. As an example, that loan of $500 might be $one thousand more a quarter season. That’s a hundred% need for simply three months!

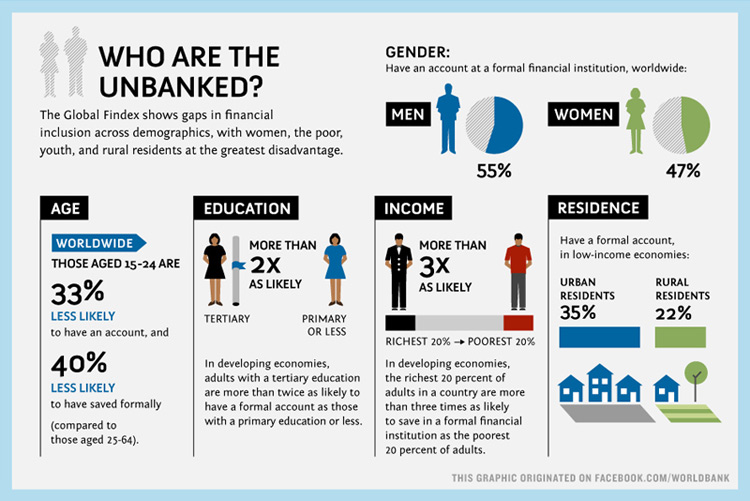

Payday loan also have recently become popular in yet another demographic. For those who have children from inside the college you have to know one to more youthful children who possess college loans today have fun with pay day loan within a stunning price. Pupils obtain student loan checks in the put minutes. However, often it happens far too late to possess basic principles that they you desire instance area and board. Thus, they consider brand new magic pill of pay day loan.

This type of finance keeps an instant turnaround going back to installment and expensive costs. So it commonly captures doing the economically insecure market. In the place of permitting they frequently diving the user for the deeper financial obligation.

This new cash advance is like putting a ring-aid to your an unbarred injury. It’s a magic bullet, not a long-term service.

About podcast below, our Registered Insolvency Trustee, Matthew Fader addresses cash advance, the risks associated with the her or him, in addition to payday loans debt settlement selection they supply so you can customers.

My personal Cash advance Happens to be An unmanageable Loans Just what Ought i Perform?

Whether your very own payday cash provides obtained out of hand they could be for you personally to find financial obligation assist. There are various steps that can lightens your of one’s expenses. The first step is always to select a licensed Insolvency Trustee, otherwise Lighted for small. Talking about financial obligation and you can personal bankruptcy pros licensed when you look at the Canada. They’ll learn the money you Norwood loans owe and implement one of the after the projects:

step one. Borrowing from the bank Counselling

Borrowing from the bank guidance will bring degree into proper money management. They give recommendations and pointers that helps you with cost management. It teach you just how to securely have fun with debit and you will credit cards. Lastly, borrowing from the bank counselling makes it possible to adhere the debt repayment plan.

2. Personal debt Administration

An Lit helps you do a loans government package. He is readily available for people who can always pay the expense over a longer period of time. Your own unsecured debts was pooled together toward one to percentage which is split up amongst creditors.