Exactly how a property Security Mortgage Performs: Borrowing Against the Household

However, if you aren’t gonna flow, you might benefit from your home well worth that have a property collateral mortgage.

- The lender allows you to use a lump sum of cash based on how far security available for you

- Your commit to pay off the mortgage (including attention) through normal money more than a fixed time period

- Your commit to install your property since the collateral. When you are not able to spend the money for loan, the lending company keeps a right to foreclose with the household

Ways to get a house Security Loan: The basics

Taking a property collateral mortgage is like bringing a great home loan. Possible sign up having a lender and you will read an enthusiastic approval process. Before you submit one to software, check out what you want doing:

Bundle to come

If you are a home collateral loan isn’t as on it since good home loan, the process does not happen straight away. Running minutes are very different from the lender, however, expect a house collateral loan application when planning on taking dos 6 months.

During this period, you’ll need to submit most of the files necessary for the financial institution, submit all the applications and files and also the house worth appraised.

Lenders ft the amount you might borrow against the shared mortgage-to-really worth ratio (CLTV). The new CLTV measures their joint mortgage (current financial equilibrium + need mortgage) contrary to the value of the home .

Have enough guarantee

Become noticed getting a property equity loan, you need to have at least 15% 20% guarantee of your home.

And additionally, your financial will never give over 85% of one’s latest property value your residence. Definitely have enough equity to really make the financing sensible.

For many who put 20% down after you bought your home, you’re probably secure. Whenever you are nonetheless purchasing home loan insurance, you may also wait before you apply.

Features good credit

- Credit history: This Route 7 Gateway loans may differ by the financial, however, will be at the least 620 (just like a conventional home loan)

- Money and a position history: The more you could show what you can do to settle, the better this new offered conditions

- Debt-to-money (DTI) ratio: Lenders usually consider a good DTI all the way to 43%

Be ready to cover the expense

Additionally be the cause of the brand new closing costs for your home security loan. As they vary by the financial, they may are house assessment costs, file thinking will cost you, lawyer charge and other expenses. You might have to spend any of these charges initial. Other fees are going to be set in your property collateral loan. Either way, anticipate paying an additional 2% 5% of your own loan amount.

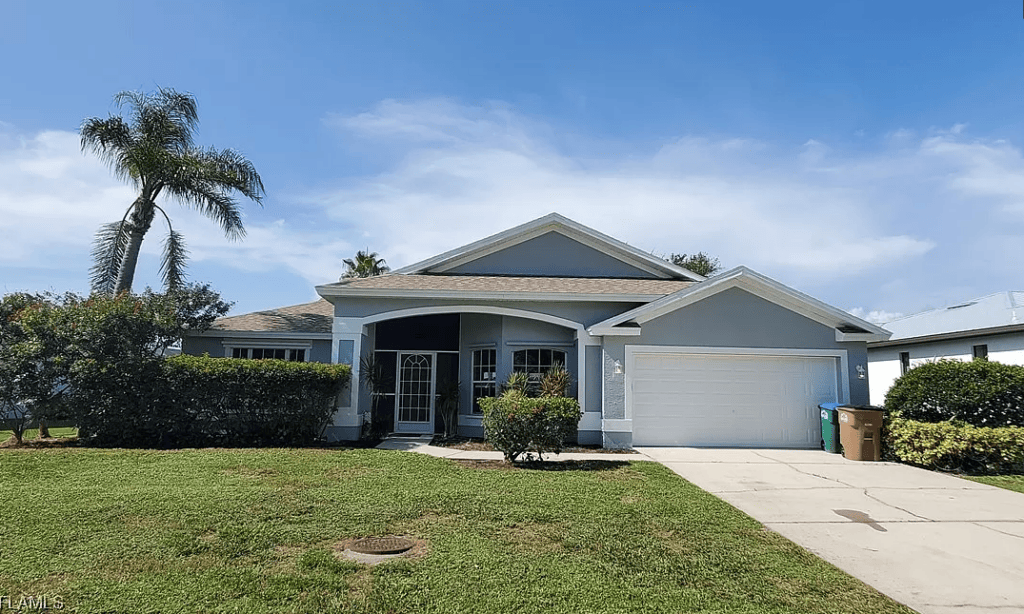

Tips Know very well what Your home is Well worth: Work-out The Really worth

If you’d like to understand how much you might acquire, it is beneficial to learn your own home’s worthy of. Before you submit the application, research your own house’s worth online otherwise hire property appraiser.

The lender will even need an appraisal by the anyone of the going for, but having your very own evaluation is a good idea, especially if there can be a positive change about shown appraisal opinions.

Automated valuation design (AVM): Online investigation

The new AVM uses analytical modeling to compare and you may examine local assets philosophy up against transformation analysis. Thereupon, the fresh new design estimates a property’s asked market value. The precision relies on the brand new model and achieving right research, very anticipate to pay a little extra getting a specialist AVM service.

Competitive business data (CMA): Query a representative

Real estate professionals get access to elite gadgets they can use so you can price characteristics to own list. If you know a friendly real estate agent, they’re able to to provide you with an effective CMA within little to no costs.

You may want to give thanks to him or her because of the it comes down a number of friends otherwise together while the number representative once you promote the home.

Watch out for guesstimates. Even though it is tempting to use the cost listed on the most popular a home webpages, the internet sites may not have the essential direct amounts. Investigate carefully!