General purpose financing with a repayment age 1 to help you 5 age. No files is needed. Domestic loan which have an installment period of 1 to help you 15 years. Papers required.

A domestic loan can be used simply for the acquisition or framework of an initial house. The home shall be a home, condominium, offers during the a collaborative homes organization, a good townhouse, boat, cellular home, otherwise leisure automobile, it can be used since your first household. The newest residence have to be purchased (in whole or in part) by you. You can obtain a residential loan having developing another type of household otherwise to find a preexisting residence, although not to have refinancing otherwise prepaying an existing mortgage, to have renovations or solutions, for selecting aside a person’s display on your own latest residence, or for the purchase from house only.

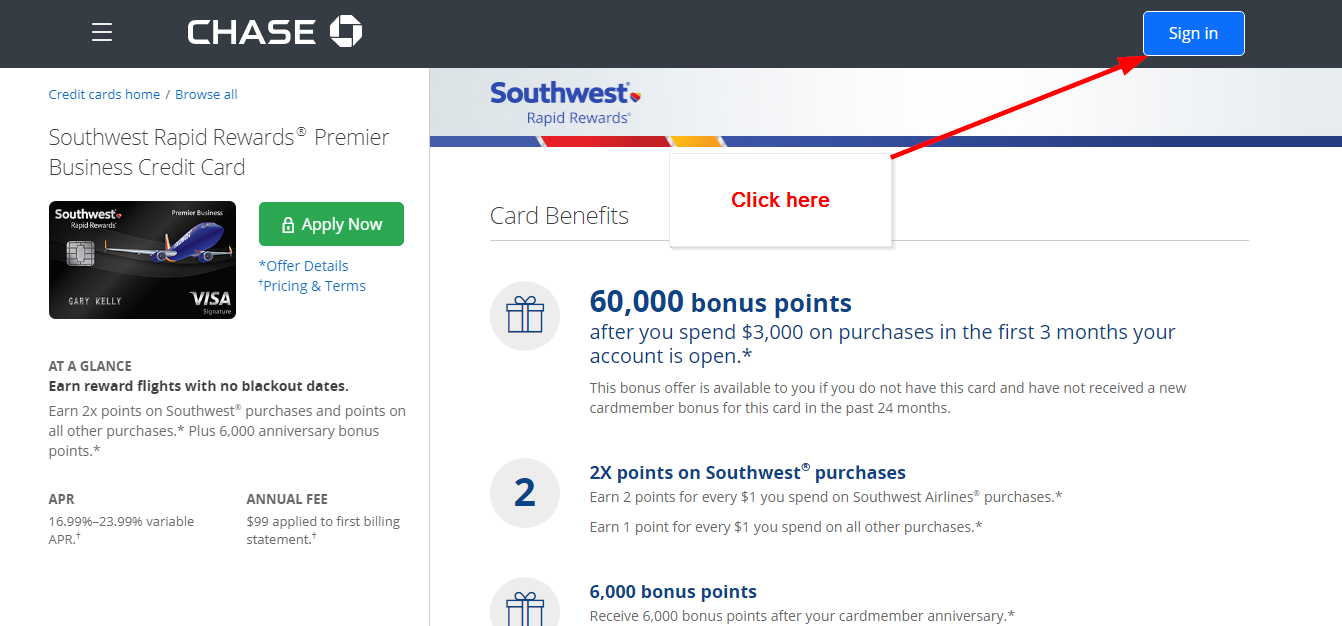

Thus, your limit amount borrowed ount you are permitted obtain, sign in My personal Membership to the Tsp website ( and click on the Tsp Funds

Restrict loan amount. The maximum loan amount you could acquire is the tiniest off the following: (1) The benefits and you may earnings for the the individuals efforts throughout the Thrift Coupons Plan membership of which you need to borrow (civil otherwise uniformed services), excluding one outstanding loan balance (the Efforts and Income Test);

(2) 50% of your own overall vested account balance (and people outstanding mortgage equilibrium) otherwise $ten,100000, whichever is greater, minus any aside-position financing balance (the internal Funds Service (IRS) Vested Equilibrium Try); otherwise

(3) $50,one hundred thousand minus their high a good loan harmony, or no, within the last 12 months (the latest Irs $50,100000 Shot). Even when the mortgage happens to be paid-in complete, it can nevertheless be believed about calculation in the event it is unlock when in the last 1 year. Such as, for folks who took out that loan having $35,100, after that paid down the borrowed funds back into full within one year, https://cashadvanceamerica.net/loans/mba-loans/ the most amount borrowed you will be entitled to obtain would continue to be $fifteen,one hundred thousand ($fifty,one hundred thousand without $thirty-five,000, the best the equilibrium over the past 1 year) whilst money might have been gone back to your bank account. Note: The above example is based on the belief that the Internal revenue service $fifty,000 Sample ‘s the straight down of one’s three restriction loan amount examination.

Your bank account harmony is recalculated at the conclusion of for every single team time centered on that day of closing express pricing and one deals canned for the membership that nights.

After you obtain from your own Teaspoon membership, the borrowed funds try disbursed proportionally off people conventional (non-Roth) and you may Roth balance on your own account. Similarly, when you find yourself a good uniformed services worker which have tax-excused contributions in your conventional equilibrium, your loan commonly consist of a great proportional amount of taxation-exempt benefits too. In case your Tsp membership is actually invested in multiple financing, your loan is deducted proportionally throughout the worker benefits (and you will money towards those people efforts) you have within the for each money. The full balance is actually ount of one’s financing.

Once you repay your loan, your instalments (and additionally focus) is placed back again to the conventional (non-Roth) and you can Roth balances of your own account in the same ratio put for your mortgage disbursement. The fresh new re also-percentage count is invested in the Teaspoon account according to the most recent share allocation.

The borrowed funds interest rate you have to pay for the life of the fresh new loan is the Grams Fund’s interest rate that’s inside effect on the latest day that your particular Mortgage Contract is established.

You should be from inside the spend status to obtain a tsp mortgage since the mortgage repayments try submitted compliment of payroll deductions. For this reason, if you are not already acquiring pay (we.age., you are in nonpay position), you would not qualify for a teaspoon financing. To own civil Tsp users, nonpay updates is sold with log off without spend and you can furlough.

Really uniformed properties professionals won’t be within the nonpay standing. Yet not, while you are a member of the newest Ready Set-aside and you also had been approved by your own order to have low-attendance off planned bore times or if you had been approved by the order to execute the annual exercise agenda over a-one- otherwise several-month several months, youre believed, getting Tsp purposes, to be in nonpay standing for the days that you don’t exercise. Once you go back to pay updates, you can submit an application for a teaspoon financing.

Note: When your unit does not bore for the certain week, you’re not reported to be during the nonpay position.

While you are a FERS participant or a member of brand new uniformed characteristics, your wife need consent to your Tsp financing of the signing the latest Mortgage Arrangement that the Teaspoon will send you (otherwise which you printing in the Tsp web site, for folks who consult financing online).

Exceptions is recognized less than particular very limited situations. To learn more, refer to Function Tsp-16, Exclusion so you’re able to Spousal Requirements (TSP-U-sixteen for members of the latest uniformed attributes), which is available on the Tsp site, or from the department or service.

Hence, when you consult a loan, you ought to indicate whether you are hitched, even if you was split up from your own spouse

The newest Teaspoon commonly go after, and relate to the Agencies out-of Fairness for prosecution, individuals which tries to deprive a spouse off his otherwise the woman Tsp liberties of the forging this new spouse’s signature, by the lying regarding the marital position, or by firmly taking comparable fake strategies.